Planning for retirement

Planning for retirement is a responsibility that causes financial anxiety for many. Unfortunately, most financial advisors only focus on one thing, returns. They never ask the simple questions, “Do you know what it means to have this money?”, “Do you know how much of your money you can use and spend without running out and still leave a legacy?”, or “Do you know what the value of this money is in the form of income?” Well, the good news is that we can customize a strategy to fit your specific goals.

Having a formal, written plan for creating your retirement income is a good place to begin. That is a key benefit of The Income for Life Model®, a Personalized Analysis that outlines a process for investing your savings with the objective of creating lifetime, inflation-adjusted income. The Model may help you manage certain financial risks that can potentially devastate one’s retirement security.

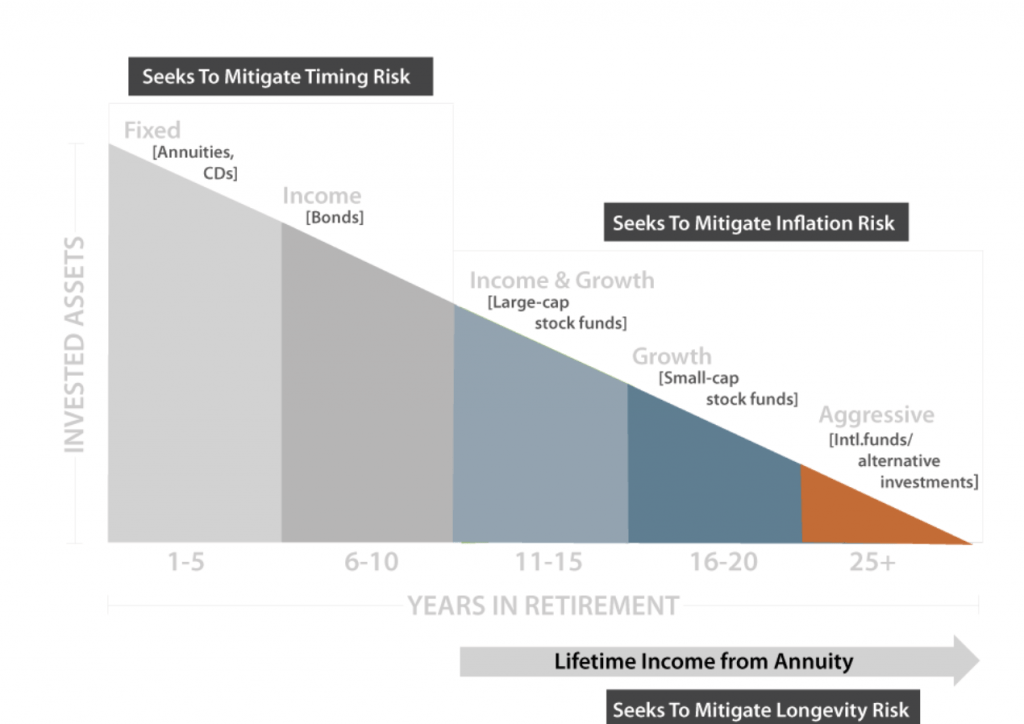

These Risks include:

Timing Risk, picking a bad year to retire- like 2000 or 2008, just when stock prices are poised to fall.

Inflation Risk, the risk that rising prices could threaten your standard of living in the future.

Longevity Risk, the risk of outliving your savings. It is the potentially adverse economic consequence of a long life.

A plan for creating retirement income should try to anticipate “big” risks and mitigate them to the extent possible. This may be the best we can do as we look forward to retirements that could last many years longer than we expect.

The Strategy

According to Kiplinger, “The biggest threat to retirement wealth is withdrawing too much money from a shrinking nest egg, because there may not be enough left to benefit from the inevitable market rebound.”

That statement is correct, and it argues for “time-segmenting” your retirement savings. Time segmentation makes it easier to align your retirement timeline with your investment strategy. It may also help you mitigate Timing Risk and Inflation Risk. By supplementing Social Security with a deferred income annuity, you can also better protect against Longevity Risk– the possibility of outliving your income.

The emphasis is on helping you manage key risks.

How it Works

In one popular approach, your deposit is shown as being allocated to six “segments” that will hold investment assets ranging from very conservative to aggressive. Segment One, the most conservative, receives the largest portion of your deposit – 28%. Successive segments receive, 26%, 20%, 13% 7% and 6% (total 100%). The segments receiving the smallest amount of money are those which hold progressively more aggressive assets. The more aggressive an investment, the more risk it is subject to. These segments will be held for the longest period of time in an attempt to achieve the best possible chance of excellent investing results.

In one popular approach, your deposit is shown as being allocated to six “segments” that will hold investment assets ranging from very conservative to aggressive. Segment One, the most conservative, receives the largest portion of your deposit – 28%. Successive segments receive, 26%, 20%, 13% 7% and 6% (total 100%). The segments receiving the smallest amount of money are those which hold progressively more aggressive assets. The more aggressive an investment, the more risk it is subject to. These segments will be held for the longest period of time in an attempt to achieve the best possible chance of excellent investing results.

Investment strategies may be subject to various types of risk including, but not limited to, market risk, credit risk, interest rate risk, and inflation risk.

The Personalized Analysis

The Personalized Analysis describes your custom plan for creating monthly retirement income.

It shows how your savings can be divided into multiple segments, each one earmarked to produce monthly income during various phases of your retirement: years 1-5, 6-10, 11-15, 16-20, and 21-25. The goal is to increase your income as you age.

Your income plan will include a “Floor”, made up of those income sources which are stable and predictable- Social Security, pensions, and income from annuities- and an “Upside,” which is that portion of your savings exposed to investment risk. In this way, some of your money is exposed to market-based growth potential, but your base monthly income is always predictable because it is produced by income sources that are not exposed to market risk. This is the key to a disciplined plan that seeks to keep pace with inflation, and that you can keep consistent with throughout retirement, and through all economic conditions.

Investments in model strategies may expose the investor to risks inherent with the model and the specific risks of the underlying investment directly proportionate to their allocation. All investments involve the risk of potential investment losses, including the loss of some or all of your principal.

© Copyright 2005- Wealth2k, Inc.

WEALTH2K, INC. DOES NOT PROVIDE INVESTMENT ADVICE.

The projections or other information generated by The Income for Life Model calculator related to total returns are hypothetical illustrations of mathematical principles that do not predict or project the performance of an investment or investment strategy. The computations of future returns are based upon assumed variables and inputs made directly by the user and does not guarantee future results. Moreover, the computations do not reflect investment costs or taxes, if any.

The Income for Life Model, Hybrid Time-Segmentation and ROI Reliability of Income are registered trademarks of Wealth2k, Inc. Three Big Risks, Constrained Investor, What's My Income, What's Your Income? and Income Floor are trademarks of Wealth2k, Inc. Knowing Your Number is Not the Same as Knowing Your Income is a service mark of Wealth2k, Inc.

Investing involves risk and you may incur a profit or a loss. There is no guarantee this model will perform as planned. If the model underperforms, the income levels and assets could be significantly reduced.

Purchase of an annuity contract through a qualified plan does not provide any additional tax-deferral benefits beyond those already provided through the plan. If you are purchasing an annuity contract through a plan, you should consider purchasing it for its death benefit, annuity options, and other non-tax-related benefits.

Jeff Riesberg, CLTC is not affiliated with Wealth2k.

Wealth2k, Inc Terms and Privacy Policy